virginia state retirement taxes

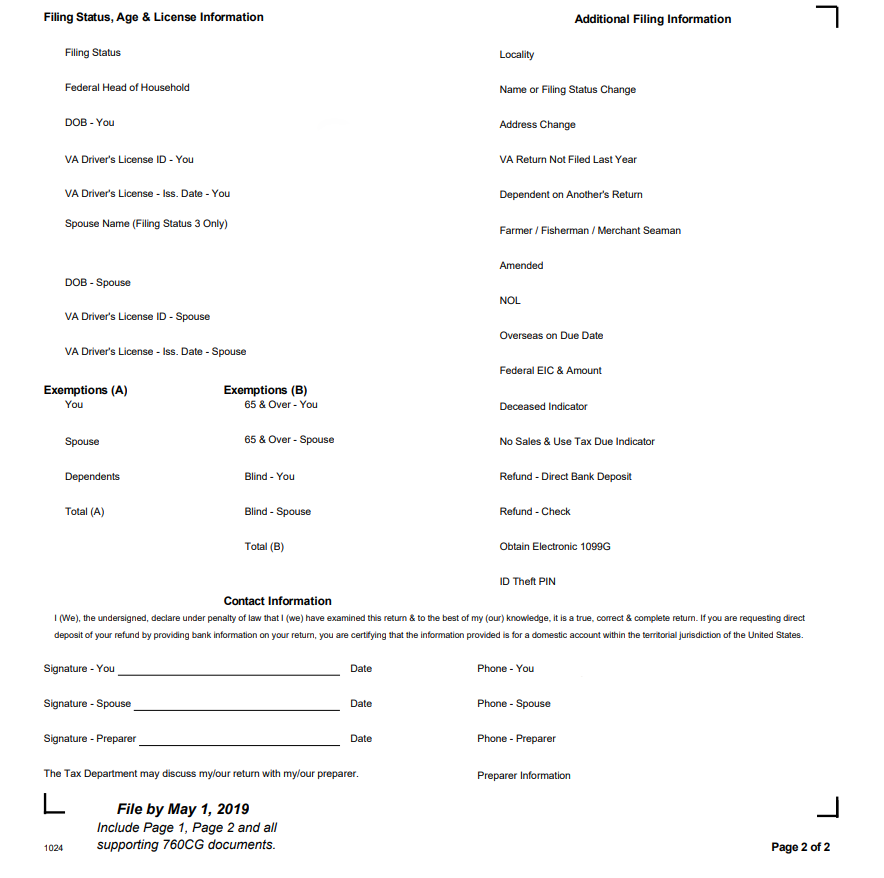

If you are a Virginia resident file your income tax return on Form 760. Ed Petersen USAF Ret president of.

Virginia Retirement System Pension Info Taxes Financial Health

A Virginia resident return must include income from all sources.

. And because Virginia is a tax-friendly state for retirees it would behoove you to invest in tax-advantaged savings vehicles like a 401k or individual retirement account. Virginias retirement system is among the top 50 largest public or private pension funds in the world. This includes most sources of retirement income including.

What is the Virginia state tax rate on retirement income. In Virginia all Social Security income is exempt from income tax as is earned income that totals less than 12000 per year. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year provided they are on extended active duty for more than 90 days.

Seven states have no income tax and two only tax interest and dividends. If you have the PLOP paid directly to you VRS will deduct 20 for federal income tax and if you live in Virginia 4 for state income tax. Kevin Stitt signed a bill May 26 granting full exemption on military retirement pay.

The deduction is increased to 20000 for 2023 30000. Were thrilled about it said Lt. You can check the status of your Virginia refund 24 hours a day 7 days a week using our Wheres My Refund tool or by calling our automated phone line at 8043672486.

The average property tax rate is under 1 and the maximum possible sales tax is 6. Property taxes average about 858 per 100000 of your homes assessed value. As far as other tax rates go sales tax averages about 565.

Some points you should keep in mind. Also you must make less than 50000 as a single filer or 75000 as a joint filer. There are exceptions to this rule.

These can help add to a holistic retirement plan especially if you. Beginning in 2022 veterans 55 years of age and older can deduct up to 10000 of military retirement income and other military benefits. A resident of Virginia who accepts employment in another country is a domiciliary resident unless appropriate steps are taken to abandon Virginia as the state of domicile.

Beginning with 2022 Virginia individual income tax returns the standard deduction will increase to 8000 for single filers and 16000 for married couples filing jointly provided certain revenue targets are met. SB 401 takes effect beginning with the 2022 tax year and would expand the states existing tax break for military retirees which covers 75 of their earnings. The Internal Revenue Service IRS also may impose an additional 10 tax penalty if you receive the PLOP before age 59½.

Retirement Taxes in Virginia Federal. If those targets are not met then the standard deduction will increase to 7500 and 15000 respectively. Virginia Sickness.

Wheres my Virginia Refund. Virginia also has no estate tax or. For tax year 2021 taxpayers can exclude 65 of their federally taxed Social Security benefits on their state tax return if their federal AGI is below 50000 single filers or.

401 k 403 b and similar investments. To avoid getting hung up unexpectedly plan for retirement using the TRICK method which stands for. For example if your basic pay is 16000.

Your account will be updated automatically. With a few exceptions if a source of income is taxable at the federal level its taxable to Virginia as well. A certain percentage of the Social Security retirement benefits that are taxable on your federal tax return will also be taxable on your West Virginia state tax return.

You also can change your withholding by filing a new Request for Income Tax Withholding VRS-15 or by calling 1-888-827-3847. For every 100 of income over 15000 the maximum subtraction is reduced by 100. VRS delivers retirement and other benefits to Virginia public employees through sound financial stewardship and superior customer service.

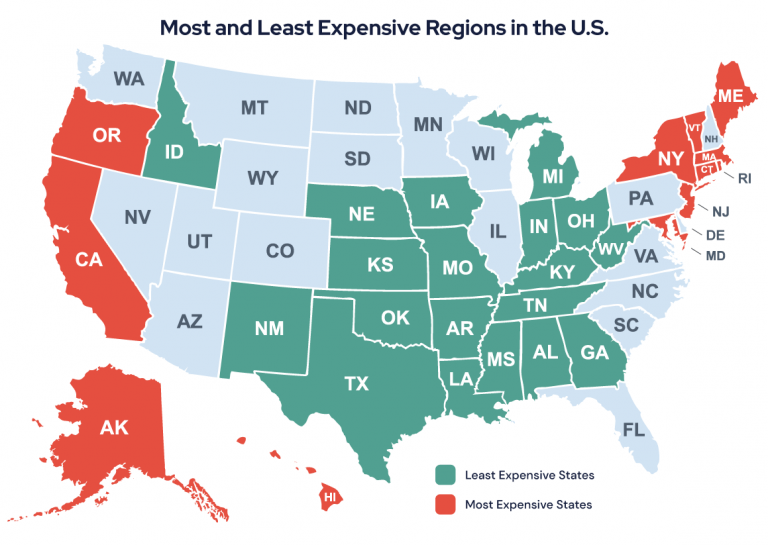

Fortunately Virginia has some of the lowest overall tax rates in the nation which makes it very attractive to retirees. In addition to state taxes on retirement benefits consider others when evaluating tax-friendly states for retirees. A Kiplinger Special Report.

State income tax rates range from 2 for up to 3000 of taxable income to 575 for incomes over 170002. That would add up to taxes of 1200 on that retirement account income taxes that you wouldnt have to pay in states like Alaska which has no income tax and Mississippi which exempts retirement account income. But you can deduct as much as 12000 on your return if you are at least 65 years old.

As you enter retirement dont let confusion about your taxes keep you from enjoying everything Virginia has to offer. West Virginia taxes Social Security to some extent but is phasing that tax out entirely by 2022. In the Virginia Retirement System pensions earned in Virginia are subject to state income taxes.

The income tax calculation tool in myVRS allows you to see the impact of any changes to your tax withholding amount and to submit your changes online. Lets say your effective state tax rate in one of these states is 4 and your annual income from your 401k is 30000. Several other states have a.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

State By State Guide To Taxes On Retirees Kiplinger

Best Worst States To Retire In 2022 Guide

Tax Friendly States For Retirees Best Places To Pay The Least

Instructions On How To Prepare Your Virginia Tax Return Amendment

Virginia Retirement Tax Friendliness Smartasset

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

Virginia Taxes And Your Retirement Virginia Tax

Virginia Retirement Tax Friendliness Smartasset

Where S My State Refund Track Your Refund In Every State

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Corporate Income Tax Rates And Brackets Tax Foundation

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

States That Don T Tax Retirement Income Personal Capital

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)